The federal tax code incentivizes businesses to produce goods domestically instead of off-shoring that production. And making beer is actually producing beer. Your fundamental business activity qualifies you for what is called a Section 199 Domestic Production Activities Deduction.

C laimed on Form 8903, it is calculated based on what is called production activities net income. This is essentially all of the revenue generated by selling beer (directly in a taproom or via wholesale accounts) minus the direct and attributable costs of producing & selling the beer sold. Multiply this number by 9% and score a well-deserved deduction directly from your tax liability!

laimed on Form 8903, it is calculated based on what is called production activities net income. This is essentially all of the revenue generated by selling beer (directly in a taproom or via wholesale accounts) minus the direct and attributable costs of producing & selling the beer sold. Multiply this number by 9% and score a well-deserved deduction directly from your tax liability!

Keep in mind that side businesses such as selling prepared foods or merchandise are not production activities and must be excluded. Similarly, the labor and associated overhead devoted to these activities must also be excluded. Fortunately, smaller businesses generating less than $5 million dollars in gross revenue can use a simplified equation to proportionally allocate these expenses.

One more thing to keep in mind is that this deduction is capped at 9% of 50% of W2 wages. So, if you do it all with a very small crew or rely on fellow stakeholders, you may find this deduction capped. There is a way to make the compensation of stakeholders (partners or S-corp members) equivalent to W2 income using a portion of W2 wages reported on a K1. You’d need to consult with your tax preparer for the specifics. Still, it’s pretty unlikely you’d run into this cap unless you have an unfathomably profitable operation. Consider that if your production activity net income is $100,000. 9% of this is $9,000. So, if you paid a part-time employee $18,000 in that year, you’ve satisfied this cap.

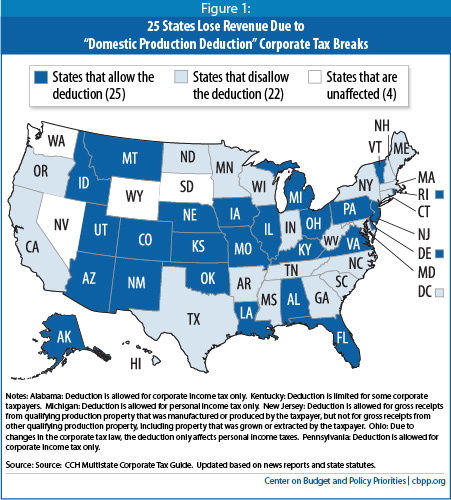

Tax analysts estimate that this deduction is equivalent to a 3% gross reduction in taxes for qualifying businesses. While it helps at the federal level, many states have found that they are actually losers in allowing this deduction at the state level (due to it being applicable across state lines), so a number of states, including New York, Connecticut, Massachusetts, New Hampshire, and Maine disallow it when filing your state taxes. Just one more thing for your tax preparer to keep track of!

Tax analysts estimate that this deduction is equivalent to a 3% gross reduction in taxes for qualifying businesses. While it helps at the federal level, many states have found that they are actually losers in allowing this deduction at the state level (due to it being applicable across state lines), so a number of states, including New York, Connecticut, Massachusetts, New Hampshire, and Maine disallow it when filing your state taxes. Just one more thing for your tax preparer to keep track of!

Keeping track of and categorizing the information that informs the production activities net income is something that a quality bookkeeper like Draughts & Ledgers do as part of the basic level of service provided! If we can’t kill your taxable income with Section 179, we’ll help keep it as low as possible so that you can continue to invest in the brewery you’ve always dreamed of!